I have never been one for banking services, especially virtual credit cards. But one day, a friend of mine asked me if I want to get $10 for free and I said “why not?”.

At that time, there was a promotional referral program from Revolut where you got $10 for free. That promotion is not available anymore, but that is the reason I got into Revolut.

Not going to lie here, it was a good decision and I will tell you why right now!

General Information

So, what is Revolut?

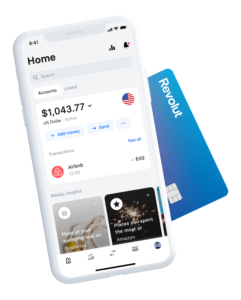

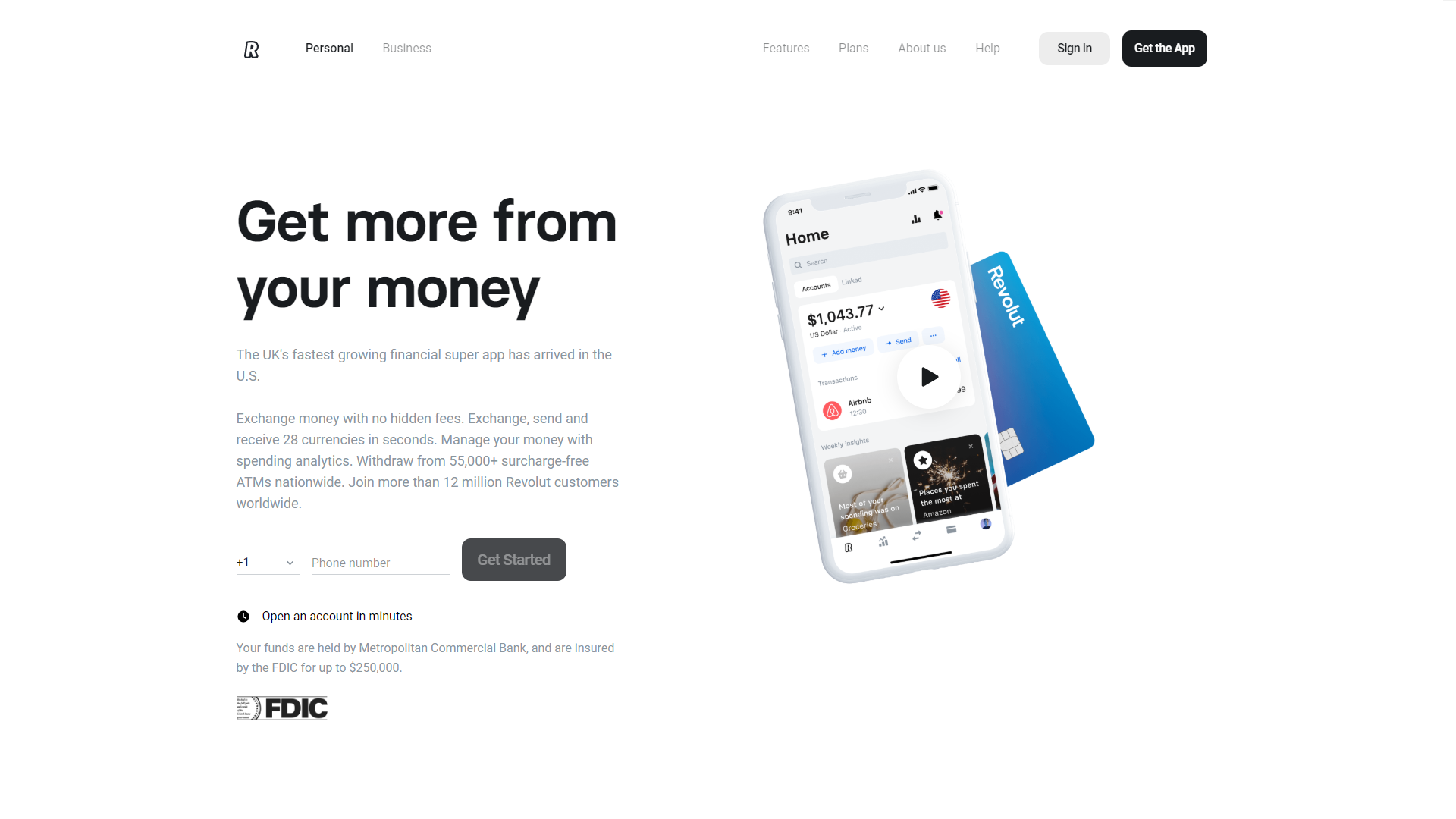

It’s an online bank (Neo bank as they call it), it has no physical subsidiary. You can’t go to your “local” branch or something like that and talk to an employee face to face. Everything is ONLINE. It’s done through their mobile app where you can find text support if you encounter any problems.

They offer physical debit cards as well, which are delivered for free and take about a week or less to arrive. You also have the option to order “fancier” credit cards but I will explain that later.

There are a few ways to top up your Revolut account:

- Transfer from a classic bank by providing either your IBAN code or with a credit card

- You could get someone to send you money if they also have Revolut. It’s as simple as just giving that person your phone number. Their account is connected to the Revolut account

- Paypal withdrawals

- Google pay is also available.

Every transaction you made can be seen inside the app with all the details you could possibly need and even more. (fun surprise for me to see the logos of the companies where I used my Revolut card, nice touch)

The company is based in the UK, with its headquarters in London, England. It is available in the European Union and Switzerland, the United States of America and Canada, Singapore and last but not least Japan, it has plans to go world wide as fast as possible. Since it is based in UK, you will be provided with a UK IBAN code, more specifically GB (Great Britain)

It supports a lot of currencies and you can withdraw from any ATM with no fees for up to about 200$. You can always upgrade for more. This was already eye opening for me. At a traditional bank you need to open an account for every currency. With Revolut you don’t need to do that (also my bank has a 1$ withdrawal fee for any amount).

Why does Revolut work like this? Because it has a currency exchange right inside the app.

Features

You can keep exchanging between over 30 currencies for profit (Forex trading) up to 1300$ with no additional fees. This is for the free version of Revolut. Anyone can upgrade to increase the no-fee limit.

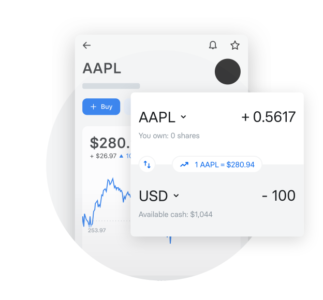

Speaking of making profits, they have stocks!

It has stock trading, yes, they have the popular ones like Apple, Google, Amazon, Netflix etc. You can buy with as much money as you want, as low as 1$. Their feature allows you to buy a part of an entire stock. Let’s say you want to buy apple, you don’t have to pay the entire amount for a full stock which would be a few hundred dollars easy.

Revolut offers a small graph for stock tracking, but it is unreliable at best. I suggest you follow the evolution of your favorite stocks from a more professional website. I’m sure they will update it to be better in the future.

As for fees, you have 3 trades for free per week, quite reasonable if you are not a hardcore day trader. This limit increases with the premium versions of Revolut.

Personally, I put $50 into stocks just to try it out and got a 20% profit playing with Netflix for two months. Also be careful if you want to sell and withdraw the money. It will take a few days until you have access to it. They have to sell the actual stock and move the money around back into your account.

But wait… there is more!

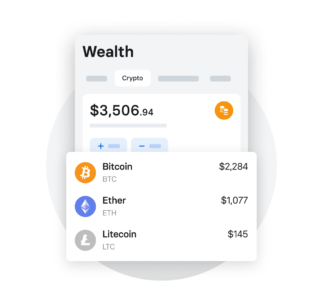

Crypto anyone? Yes, they have crypto currency! Not many, but they have the “big players” like Bitcoin, Ethereum, Ripple and more!

Keep in mind that for the time being, users can’t import or export coins to blockchain wallets. They manage them for you and Revolut works as an intermediary. Imagine it like stocks for crypto. They are working on giving more flexibility to traders in the future.

Similar to stock trading, I will have to advise you: don’t solely rely on Revolut for crypto trading. If you just want to test the waters and buy some for experimentation, it’s a great place to get started. Otherwise I recommend a more advanced platform. You can check out this article with my suggestions.

They also have commodities management. Which basically gives anyone the option to buy gold and silver for any amount they want.

Another interesting feature is the Vault. This is an interesting one, it helps you save money by putting spare change into a virtual account / safe. It rounds up your payments.

Let me give you an example of how this works. Let’s say you pay $9.99 for something. This feature rounds it up to $10 and puts $0.01 in the vault. You can also program it to take recurring amounts out of your main wallet. Set it up to grab $5 every month and put it into the vault. It is quite useful.

Premium

Like any other thing recently, it also has premium options (shocker, right?).

Premium membership does give you some cool benefits like a nicer physical credit card. The most expensive premium offer gives you a debit card made of metal and you can choose colors!

Other benefits would be lifting some restrictions like the 3 free trades per week in stocks, they will rise to 8 and unlimited, depending on the premium option.

It has another interesting feature which refreshes your virtual card and creates a new one after every transaction. This protects you from fraud. Hackers can’t steal a card if it “self-destructs” after every transaction.

Insurance? Apparently so. It has something called a “Global Travel Insurance” in case you have some emergency medical expenses on your travels.

Revolut offers 2 upgrade plans:

- Premium – $9.99 / month

- Metal – $16.99 / month

They both have a lot of benefits and features, all of them are displayed inside the app and if you decide to upgrade, you should review them thoroughly.

Revolut vs Traditional Banking

As you can see, there’s a big difference between Revolut and your traditional bank.

And it doesn’t stop here. Besides all the improvements we talked about, they plan to add NFC support as well. You’ll be able to pay with your phone directly from the Revolut app. This is different from integrating your card with a service like Apple pay, which already works by the way.

You have many features inside the app itself. Add to the list instant transfers to other Revolut members and very low wait time to receive money from anywhere else. An international transaction using classic banks in my country is about 4 business days, Revolut gets it done in 1-2.

It operates as a UK account for now, but they are moving to Lithuania. All this to benefit from the EU laws and slowly move away from the uncertain Brexit fiasco. The banking license was approved and everyone will be transferred slowly.

Did I mention that Revolut is extremely useful for traveling? You can withdraw from anywhere, in the currency you need with no or very small fees.

Concerns

The only downside is that some people reported that their accounts have been frozen for “no reason”, but every time this happened it included relatively big sums of money, what does this mean?

Well, since it does not have physical subsidiaries, their relationships with the governments of other countries is quite tricky. With that in mind you can probably figure out that many will try to launder money or avoid taxes. Whenever Revolut sees suspicious activity, they will freeze your account until you can prove your money is legal.

Example:

You use Revolut for 1 year and every month you put $200 in it. If you suddenly drop $10.000 out of nowhere, that is suspicious and will probably end up with a frozen account. You can always talk with them and figure out what to do next.

Usually these incidents get resolved with no problems, but, as always, people like to complain. Personally, I had no problems with it and I have been using Revolut for almost 2 years.

My advice: Get it.

I strongly suggest you take some time and play with the app. You’ll discover all the cool things it has to offer. It’s quite impressive and it will only get better with time. Download it here.

Revolut may come in handy even if you don’t travel. Keep it there as a backup in case you will. It’s free.

Or keep it just to pay for something where your classic bank has limitations.

No joke, I stayed with it because I wanted to protest my bank who charged me 1$ for withdrawing 1$. (Clearly that will show them)

It has also been very useful for my online transactions as well as snatching a couple more trials for different services like Skillshare. (you are welcome)

Thanks for reading. I’d love to know your thoughts. Let me know in the comments section below.

Leave a Reply

You must be logged in to post a comment.